As far as financial planning I have only been specific about what lies ahead during the next year. And seeing as I made this plan when I was working two jobs, it is in serious need of an updating. As far as planning 5-10 years in advance, I have loosely laid out my goals, but I have yet to get specific.

Pros of Planning Ten Years in Advance

It’s nice to have a piece of paper that can act as a financial guide, even if not followed to a T. Planning so far in advance forces you to think about what you want your financial life to look like five or ten years down the road.

Here are a few financial categories to consider when making your ten year plan:

• Amount of Cash Savings

• Amount in Retirement Funds

• Amount of Debt

If you are working toward any longer term financial goals such as paying your mortgage off early or saving for a down payment for a house, be sure to include these, as well as any of your other goals.

Cons of Planning Ten Years Ahead

One of the biggest cons of planning so far ahead is that you just don’t know (income-wise) what the future will hold. Take me for example. Currently I just make enough money to keep my head above water. However, I think that should change in the near future.

Should I plan with the income I am bringing home now? (Which pretty much allows for zero planning.) Or, should I think positive and plan a little more ambitiously?

I think I’ll choose the latter of the two.

My Ten Year Plan

I am being a little ambitious with my plan. But, you never know, in a couple of years I may be a lot better off than I am now and be able to adjust my numbers up. So, this is my plan.

In Ten Years I Want to Have…….

• $10,000 in my emergency fund.

• $100,000 of my own money put into retirement accounts.

• 2 Investment Properties (Bought for somewhere around $50k each)

This sounds reasonable to me. I have been contemplating going back to two jobs which would make this plan doable. When I had two jobs my income was nearly double of what it is now.

Housing is something that could be on this list but as for right now I don’t know what I want to do in terms of buying a house or just living in the trailer for a while. I’ll add a housing goal when I get that figured out.

I have almost hit this year’s $5k emergency fund goal with only $450 left to go. So in the next 10 years I would need to save $205,000 dollars or approximately $20,500 per year.

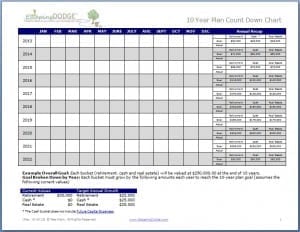

I found some very helpful worksheets for laying out a ten year plan at Escaping Dodge. These worksheets help you plan and record how much money you need to be savings and allow you to mark you progress accordingly. If you want to check the worksheet out visit this post, Charting Your Ten Year Plan Progress.

Do You Have a Ten Year Plan?

Hi Alexa,

I’m thrilled you found value in my worksheets. They have been an invaluable tool for me personally for exactly the reasons you state. You’re right that 10 years seems like a long way off and a lot can change. The most important part of a long-term plan is to start thinking that far in the future. It’s eye opening.

When my mentor and I developed this specific worksheet I looked at her like she was nuts. I felt it was IMPOSSIBLE to ever achieve what we set out on paper…but there’s power in putting your goals on paper and regularly going back to them.

Just because you put a goal on paper, however, doesn’t mean you can’t change it when you have new data about your life (like more income). I do like that you are taking the approach that you’ll be earning more as time goes by. That will also help to keep you focused on achieving those income goals.

I just love your site. Sharing your story will be so inspiring to all those single moms out there. Heck, you inspire me!

Ree ~ I blog at EscapingDodge.com

I have a five-year plan. This helps me plan ahead and visualize the big picture. I started this in 2011, so with every passing year, I update my goals and tack on another year to the plan. One of my plans is to trade in my car for a used car in a couple of years. Knowing that’s on the horizon, I’m more careful with my spending on things like dining out and vacations.

I don’t think there is any problem with planning years in advance. Sure there are variables that you can’t foresee but its good to have general goals. Though 10 years is a little far…I think I’m with Tina…5 years is a good time for more specific goals and 10 years for more general ones.

I’ve never been able to see ten years in advance ! In ten years, my youngest will be starting college. ( if that is what he wants to do.) I can’t imagine not having kids in the house. Maybe one of the older kids will move back in. ; )

~ Christie

I think for us the written 5 year plan is realistic for us. We talk about the future and what we would like to do but nothing is concrete or written in stone as it’s so far away. We do plan for retirement and talk about what we would like to do but nothing solid. I think it’s great if you know what you want from life 10 years in advance as it opens up the path to start saving and preparing now for what you want to accomplish. Well done. Mr.CBB

I like making long term goals like this, Alexa. They may or may not come to pass, as life changes SO much usually in that amount of time, but I think it’s good to at least have a plan in place. It can always be modified later. Great work on the emergency fund, by the way!!

I think it would be great to have a short and long term plan. That ten year plan will fall under the long term. Ten years is a long time, anything can happen or new opportunities will come along the way. The goal for the tenth year will materialize if a yearly plan will be implemented. If the plan is doing good, then find ways to make it better but if does not do good thus find ways to improve it. Still, it is best to have a plan towards the dreams. =)