Credit scores are the one universal number that most financial institutions, landlords and insurance companies use to gauge your level of financial responsibility.

Credit scores are the one universal number that most financial institutions, landlords and insurance companies use to gauge your level of financial responsibility.

I’ve written before about how having a good credit score has saved me more than $100,000 (and how my credit score wasn’t always so great). After I improved my credit score I helped my brother work on his and another family member work on hers with great results.

If you have a bad credit score it’s completely possible to turn it around. Like anything worthwhile, rebuilding your credit score will require some patience and perseverance. Here’s how to rebuild your credit score.

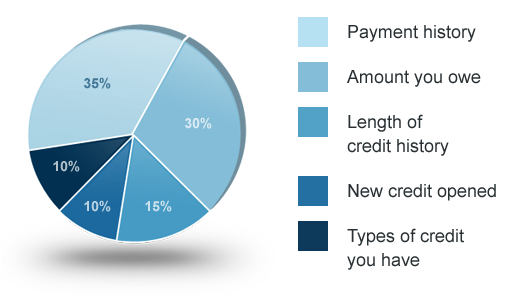

How Your FICO® Credit Score is Calculated

Before you can begin working on improving your credit score you need to know how it’s calculated.

Payment History – Your payment history (whether you make payments on time or not) is the largest part of your credit score coming in at 35%

Amount You Owe – The amount you owe makes up 30% of your credit score. You should never have all of your credit used up. To figure out your credit utilization number divide your total revolving card balances by your total revolving card limits. A good utilization ratio is between 1-15%.

Length of Credit History – The length of your credit history makes up 15% of your credit score. This is why it’s a bad idea to cancel credit cards you’ve had for a long time if you’re wanting to improve your credit score.

New Credit Opened – New credit opened accounts for 10% of your score.

Types of Credit You Have – The types of credit you have open account for 10% of your score.

# 1- Know Exactly Where You Stand

You can’t successfully make a plan to raise your credit score if you don’t know where you’re starting from.

Make a list of all of your current credit accounts. Write down credit limits and balances for all of your credit cards, personal loans, student loans, and mortgages if applicable. Next visit AnnualCreditReport.com and request a copy of your credit report from all three credit bureaus.

Also, if you’re a Discover cardmember you can check for your FICO® Credit Score for free on monthly statements and online.

Check over the reports to make sure everything is accurately reported.

# 2 – Lower Your Debt to Credit Utilization

Aside from your payment history your debt to credit utilization is the most important factor pertaining to your credit score. As a general rule of thumb your debt to credit utilization should be in between 1-15%.

To see what your current utilization ratio is tally up your total available credit and divide that by your total debt. If this number is above 15% you need to work on lowering it.

If you currently have a very high debt load just lowering the amount of debt you owe should help improve your credit score.

# 3 – Begin Rebuilding Your Credit

As you can see from the chart above the most important part of determining your credit score is your payment history. Making payments on time for a long period is crucial. That’s why it’s important you don’t close any long standing credit card accounts. It’s also important that you are making payments that are reported to the credit bureaus.

If you have an open credit card account with a balance continually make your payments on time. If you have a credit card account without a balance consider filling your gas tank once per month with the card and then paying it off each month.

In the event that you don’t have any payments being reported to the credit bureaus, and have bad or no credit, opening up a secured credit card is a great choice.

A secured credit card requires you to put a security deposit down which becomes the credit line for the account. One good option is the Discover It® Secured Credit Card, which offers all of the same perks as their regular credit cards including rewards and your free FICO® Credit Score on monthly statements and online. Discover also reviews secured card accounts after one year to see if customers can qualify for a regular cardmember account.

# 4- Always Pay Your Bills on Time

The number one reason people have bad credit scores is because they fail to pay their bills on time. I’m guessing this comes as no surprise to you!

While it might seem obvious I feel like it’s worth saying here: always pay your bills on time.

Do NOT, under any circumstance, take on more debt than you can pay back. Even if you can only make the monthly minimum payments on your debt each month do what you have to do to make them. Discover cards also offer no late fee for your first late payment.

# 5 – Stay the Course

Building your credit score is simple, but not easy. It’s going to take some time to see a big improvement in your credit score but if you follow these simple pieces of advice and stay the course you’ll eventually see the improvements you’re hoping for.

A big thanks to Discover for sponsoring this post. All of the opinions in this post are my own.

Photo Credit: CanStock Photo

Thanks, this post was helpful